A Limited Company

Q Tbn 3aand9gcrmyqvf0adywsqxclydqutn0qfbp90q Edx7ppsubh71b3rsbwe Usqp Cau

How Much Limited Company Tax Do I Have To Pay Company Bug

What Is A Public Limited Company Plc Definition And Meaning Market Business News

What Is A Company Registration Number

Sole Trader Or Limited Company Whats Better Company Bug

How To Remove A Shareholder From A Limited Company

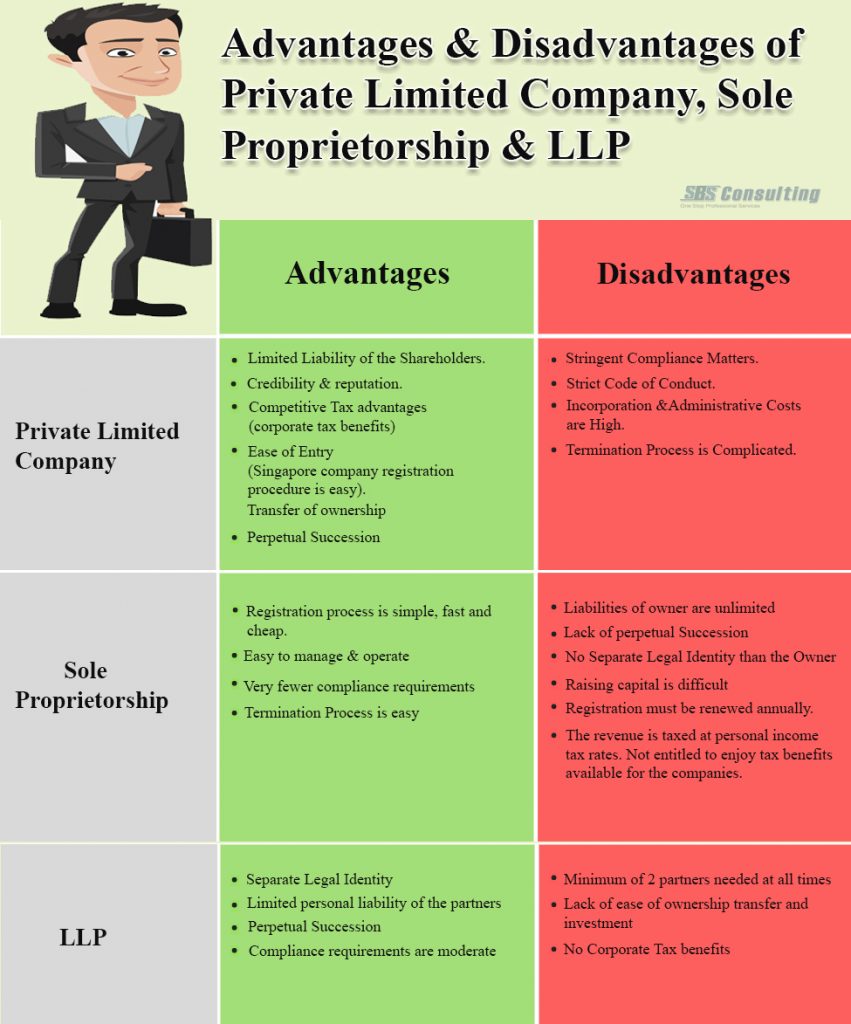

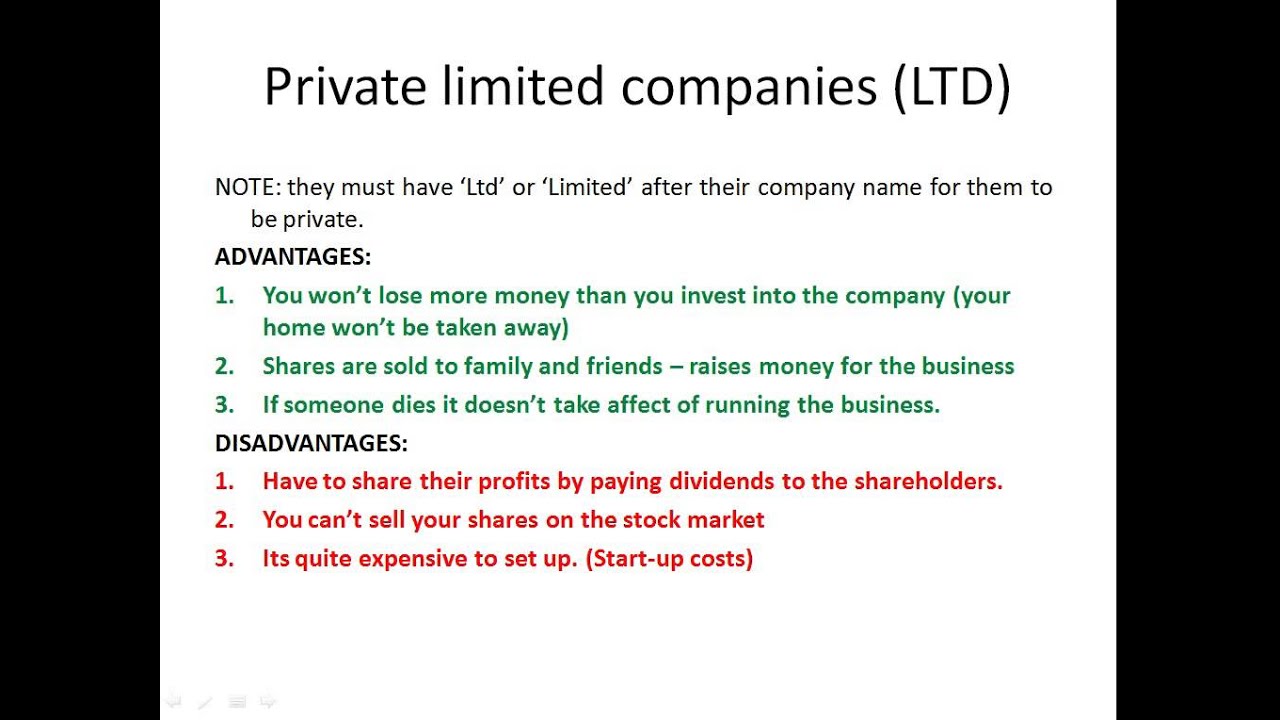

But whilst forming a limited company offers numerous advantages which are hard to ignore, it does have disadvantages too.

A limited company. This is due to the many professional and financial benefits it offers, all of which far surpass those available to sole traders or contractors working through an umbrella company. A private limited company has one or more members, also called shareholders or owners, who buy in through private sales. The limited liability company in Canada.

The business structure allows an individual to create a business as a separate entity. A limited company may be limited by shares or by guarantee.A company is any legal entity that buys and sells goods and services, usually in the pursuit of profit. This is essentially the difference between the ability of the business to pay bills as they become due or not - but insolvency also applies to the state of having more liabilities than assets.

It is registered for pre-defined objects and owned by a group of members called shareholders. In a company limited by guarantee, each. A limited company is one of the most popular legal structures for all types and sizes of businesses in the UK.

The owners of a company are protected by ‘limited liability’. Meaning of Limited Company. Most of the time, the limited liability company is met in European countries, which is why foreign investors might be tempted to ask for the incorporation of such a business form.

The liability arrangement in these is that of a limited partnership, wherein the liability of a shareholder extends only up to the number of shares held by them. Perhaps it's time to incorporate. This type of structure protects most of an owner's personal assets, and the business's income is passed through to owners' personal income.

As previously stated, private limited liability companies in Hong Kong need to observe the annual reporting and filing requirements. ,000 – Includes Name Search, Certificate of Incorporation, Memorandum Only. However, a limited company can claim tax relief on childcare costs via childcare vouchers up to a total value of £243 each month.

A Private Limited Company is a business entity held by small group of people. In a limited company, the liability of members or subscribers of the company is limited to what they have invested or guaranteed to the company. Set up a limited company:.

A private limited company is a privately-held business entity. A limited company (LC) is a general term for a type of business organization wherein owners' assets and income are separate and distinct from the company's assets and income—known as limited. Because a limited company is a distinct entity from its owners, it may be a little easier for a company to secure business.

Sun Hung Kai Properties Limited. These refer to complying with the annual accounting filing as well as maintaining the records and documents at the company’s registered address (a local address that must be maintained throughout the company’s existence). Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

In addition, a shareholder of a private limited company typically must. It is held by private stakeholders. What is a limited liability company?.

A Limited Liability Company or LLC is a business structure in which the owners or members have limited liability with respect to the actions of the company. Each subscriber to this memorandum of association wishes to form a company under the Companies Act 06 and agrees to become a member of the company and to take at least one share. A limited company, also known as a limited liability company (LLC), is a type of business ownership that determines many aspects of the way the business is run.

Setting up a private limited company can suit all sizes of business and provides various advantages over operating as a sole trader or partnership. Definition of limited company. The main difference between the two options is that an Irish Limited Company is a separate legal entity from the individuals involved (Directors and Shareholders).

We are unique in the sense that not. A limited liability company is organized according to the state laws where it is formed and operated. Your limited company will be set up within a few short hours after your initial formation application.

A value is attached to the shares at the time of incorporation. Limited companies may be limited by shares or by guarantee. This means that everything from.

A limited company is a private company whose owners are legally liable for its debts only to the extent of the guarantees they have agreed to or the capital they have invested in it, i.e. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Use of home as office If your home is the heart of your business, you’re able to claim a percentage of your household costs and utility bills as business expenses.

Instead of paying income tax as an individual, a limited company pays corporation tax, which currently sits at 19 per cent. One of the main advantages is the fact that liability is only limited to what you invest in the company. Everything from the company bank account, to ownership of assets and involvement in tenders and contracts is purely company business and separate from the interests of the company’s shareholders.

Startups and businesses with higher growth aspiration popularly choose Private Company as suitable business structure. A limited company is a company ‘limited by shares’ or ‘limited by guarantee’. A limited liability company (LLC) is the US-specific form of a private limited company.It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

A Limited Liability Company (LLC) is a business structure allowed by state statute. A&A Limited, parent company of the A&A Group, is a unique business consulting firm, taking out the overall strategic and operational management consulting role. What does Limited Company mean?.

Limited companies can be found in most countries, al. Directors are company employees. If you are a company director, you are ultimately responsible for understanding how your business is taxed, for registering the company to pay Corporation Tax and payroll-related taxes.

The former may be further divided in public companies and private companies. A limited company is a form of business which is legally separate from its owners (typically shareholders) and managers (formally called directors). The Canadian limited liability company is a.

Owners of an LLC are called members. Unlike public limited companies, private limited companies are legally restricted from issuing their shares through an initial public offering.As such, they cannot trade their shares on a stock exchange.With this restriction, private limited companies may find it difficult to attract outside investors to buy the shares. Beginning with a simple public limited company definition, a public limited liability company, also known as a PLC, is the version of a limited liability company, or LLC, that offers its shares to the public while still limiting its liability.

The process of closing a limited company depends on whether it is solvent or insolvent. LLCs are a type of business entity that are similar to corporations in many ways. If you own 1 share out of a total 2, you own 50% of the company.

Are you a sole trader or entrepreneur?. A limited company is a type of business structure where the company has a legal identity of its own, separate from its owners (shareholders) and its managers (directors). A limited company is a separate legal entity which has the power to own assets in its own name, to borrow and/or lend money, to make contracts and to sue and be sued in its own name.

Our all-inclusive package costs only £125 plus VAT and includes online registration, VAT & PAYE registration, share structure advice, free business banking, a 15% discount on Hiscox business insurance as well as a registered office address. This is an agreement which confirms the intention of initial subscribers to form a limited company in the first place, with the following wording:. A limited company is a completely separate entity from its owners.

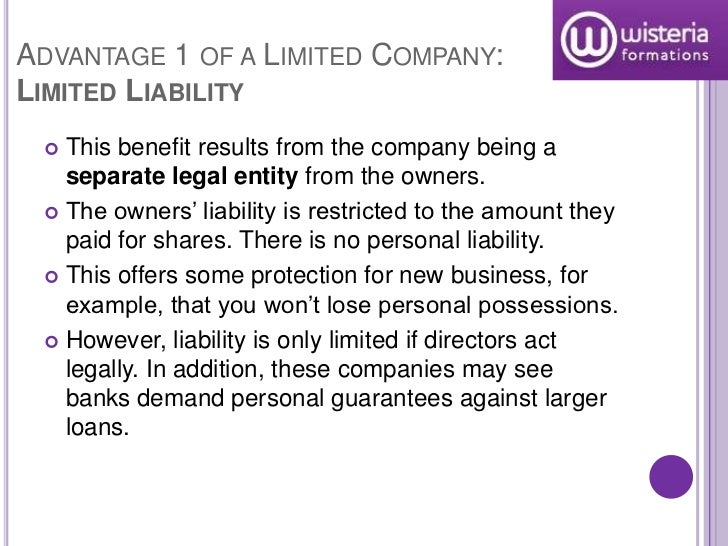

Even if a company has only one individual involved with it and that person is the only shareholder and the only director, the company is still a separate legal entity. Limited liability - In simple terms, if you run a Limited Company you are protected should things go wrong. Information and translations of Limited Company in the most comprehensive dictionary definitions resource on the web.

Avalon Natural Products, Incorporation. In the UK, it must be incorporated at Companies House. These types of company are incorporated, which means they have their own legal identity and can sue or own assets in.

Who may become a member of a private limited company is restricted by law and by the company's rules. This is reducing to 18 per cent in April 18 and 17 per cent in April 19. A limited company is a type of business structure that has been incorporated at Companies House as a legal ‘person’.

A Limited Company is an organisation that is set up to run a business. A limited company is its own legal entity. We currently offer two (2) package plans as shown below;.

A Limited Company and Sole Trader are two distinct business structures. The biggest advantage of a limited liability company is right in the name — it limits your potential liability as a business owner. Limited companies can be private or public.

A company in which the liability of each shareholder is limited to the par value of his stock or to an amount fixed by a guarantee. Mega Hospitality International Limited. Forming a limited company costs money.

It is a legal form of a company that provides limited liability to its owners in many jurisdictions. A limited company is a distinct legal entity, and unlike sole traderships, the financial affairs of a company and its directors are completely separate. A limited liability company is a type of business structure that someone can choose when they're starting a business.

Unlike a publicly limited company, where shares are traded on the stock exchange, a private limited company does not publicly trade shares and is limited to a maximum of 50 shareholders. The Hongkong and Shanghai Banking Corporation Limited. Separate entity - A Limited Company is a legal entity in its own right.

As the name suggests, LLCs provide personal liability protection to their owners. Your limited company can contribute pre-taxed company income to your pension. It limits the owner’s personal liability and can a tax efficient way to take income from a business.

1 Check if setting up a limited company is right for. After payment of corporation tax, the profits are available to distribute to shareholders as dividends. However, in Canada, the limited liability company is regarded as an unincorporated entity with the benefits of the corporation.

Step by step How to set up a limited company, appoint directors and shareholders or guarantors, and register for tax. A limited company is a type of business structure whereby a company is considered a legally distinct body. Your employer pension contributions must abide by the rules for allowable.

An LLC is not a corporation under state law;. An LLC offers the members the benefit of personal liability protection, meaning that the business liability cannot be recovered from the personal assets of the owners. Unlike a Sole Trader/Partnership all of your businesses finances are kept separate to your personal finances.

A Limited company can be created with any number of shares. Is your business growing?. Limited companies A limited company has special status in the eyes of the law.

Lite Plan – Ksh. A limited company is one of the three business structures used in the UK. It is completely separate from its owners, it can enter into contracts in its own name, and it is responsible for its own actions, finances, and liabilities.

It allows the owner to and any other shareholder to only risk their investment and keep their personal finances protected. Limited liabilities are governed under state law, and members of the LLC are called members. It shares some aspects with a privately owned company, some with a partnership, and some with a corporation.

If someone gets hurt using a product produced by your business or is hurt on property owned by your company, an LLC can prevent a would-be plaintiff from going after your personal assets. This confers the status of being a separate ‘legal person’ from the people who run it, with a unique company registration number. A company comes into existence as soon as it is incorporated (see 'How do I incorporate a company').

A Limited Company needs to file Annual Returns with the Companies Office and there is more compliance and red. Assuming all rules have been followed, as a director you will not be personally liable for any financial losses made by the company. In contrast, anyone may buy shares in a public limited company.

Forming a limited company is a popular way to operate a business. Because an employer contribution counts as an allowable business expense, your company receives tax relief against corporation tax, so the company could save up to 19% in corporation tax.

Choosing The Right Entity For Your Business Sole Trader Partnership Or Limited Company Tfmc

1st Accountants Ltd Limited Companies

What S A Limited Company Statement Of Financial Position Balance Sheet Crunch

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

How The Role Of Director And Shareholder Is Different In A Private Limited Company Legalwiz In

Limited Liability Company Llc Lawyers By Legalmatch Issuu

Contracting Via A Limited Company Advantages And Disadvantages Contract Eye

What Is A Limited Company

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

Public Limited Company Registration Service In Civil Lines Jaipur Jsons Solicitors Private Limited Id

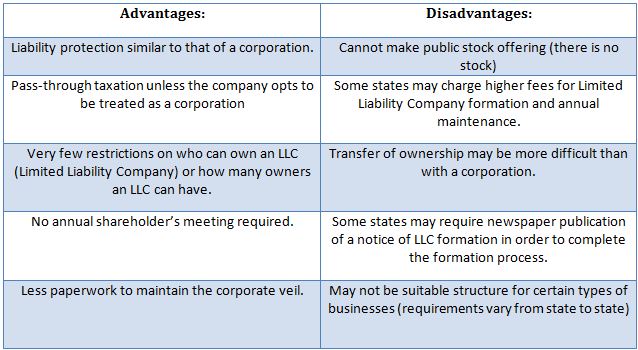

Advantages And Disadvantages Of Limited Liability Company

2 New Messages

Private Limited Companies In Sri Lanka Foreign Direct Investment In Sri Lanka

How To Register A Company In Singapore Step By Step Guide

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

Limited Liability Company Llc Definition

What You Need To Know About Private Limited Company

Registered Address Services With Free Mail Forwarding Registered Address Ltd Business Address And Virtual Office Services London

Closing A Limited Company In Spain Edco Business Consulting

How To Convert Sole Proprietorship To A Private Limited Company Rikvin

7 Advantages A Sole Trader Self Employed Business Has Over A Limited Company Bytestart

Advantages And Disadvantages Of Public Limited Company

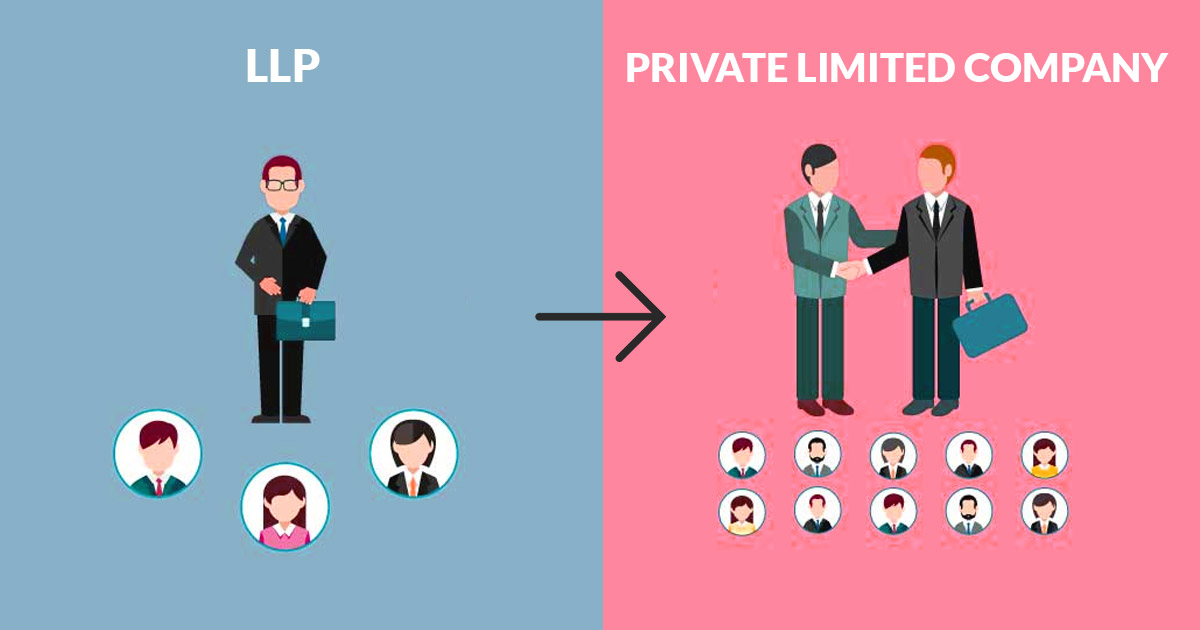

Llp Vs Private Limited Company Should More Start Ups Pick Llp Vakilsearch

Annual Compliance For Private Limited Company Registration Corpbiz

In India What Is The Difference Between A Public Limited Company And Private Limited Company Quora

Llc Meaning What Is An Llc Or Limited Liability Company Truic Business Guide

Whats The Difference Between A Public Limited Company And A Private Limited Company revision Youtube

How To Set Up A Limited Company Industry Insider S Tips

Step By Step Infographic Changing From A Sole Trader To A Limited Company Markel Direct Uk

5 Advantages Of Trading Through A Limited Company Limit Consultinglimit Consulting

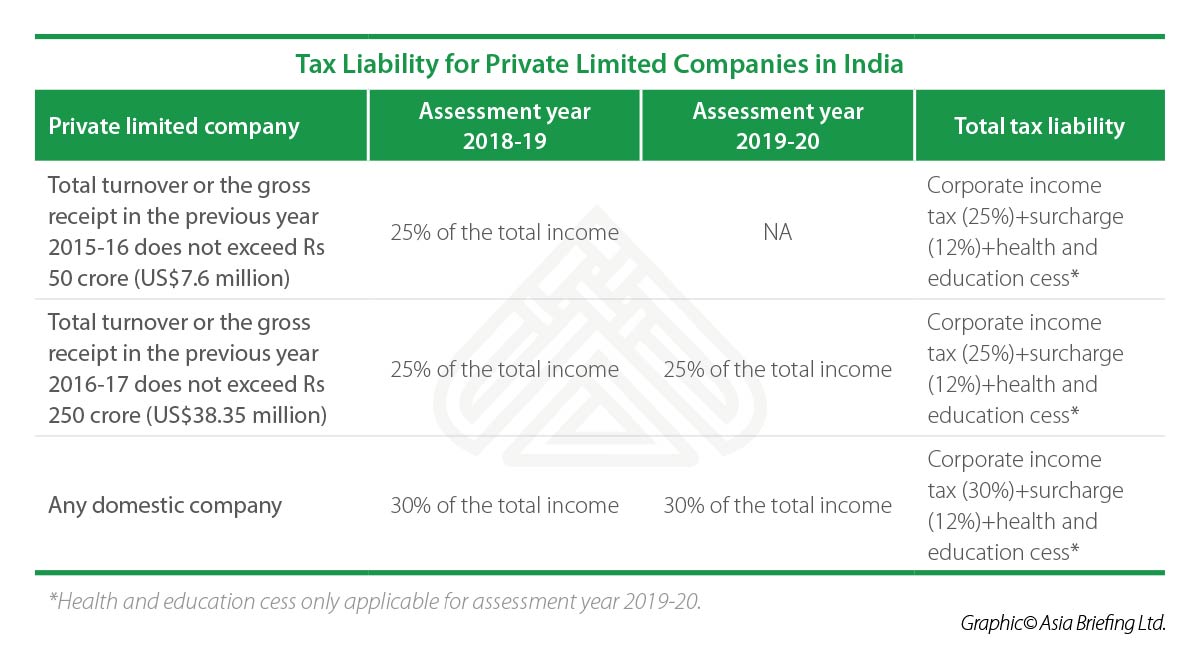

How To Set Up A Private Limited Company In India India Briefing News

What Is A Service Address In A Limited Company

Conversion Of Unlimited Liability Company Into A Limited Liability Company

Public Limited Company Advantages And Disadvantages Times Connection

Llc Limited Liability Company Formation Corpco

Why A Limited Liability Corporation Llc Is A Good Idea Dingo Creative

What You Need To Know About Private Limited Company

Difference Between Public Sector And Public Limited Company With Table

Private Limited Company Registration Process In 5 Steps In 19

Easy Guide To Convert Llp Into Private Limited Company Sag Infotech

Private Limited Company Eligibility Registration And Related Provisions Taxgoal

Register A Private Limited Company In Malaysia

What Is The Difference Between A Private And Public Limited Company The Accountancy Partnership

Private Limited Company

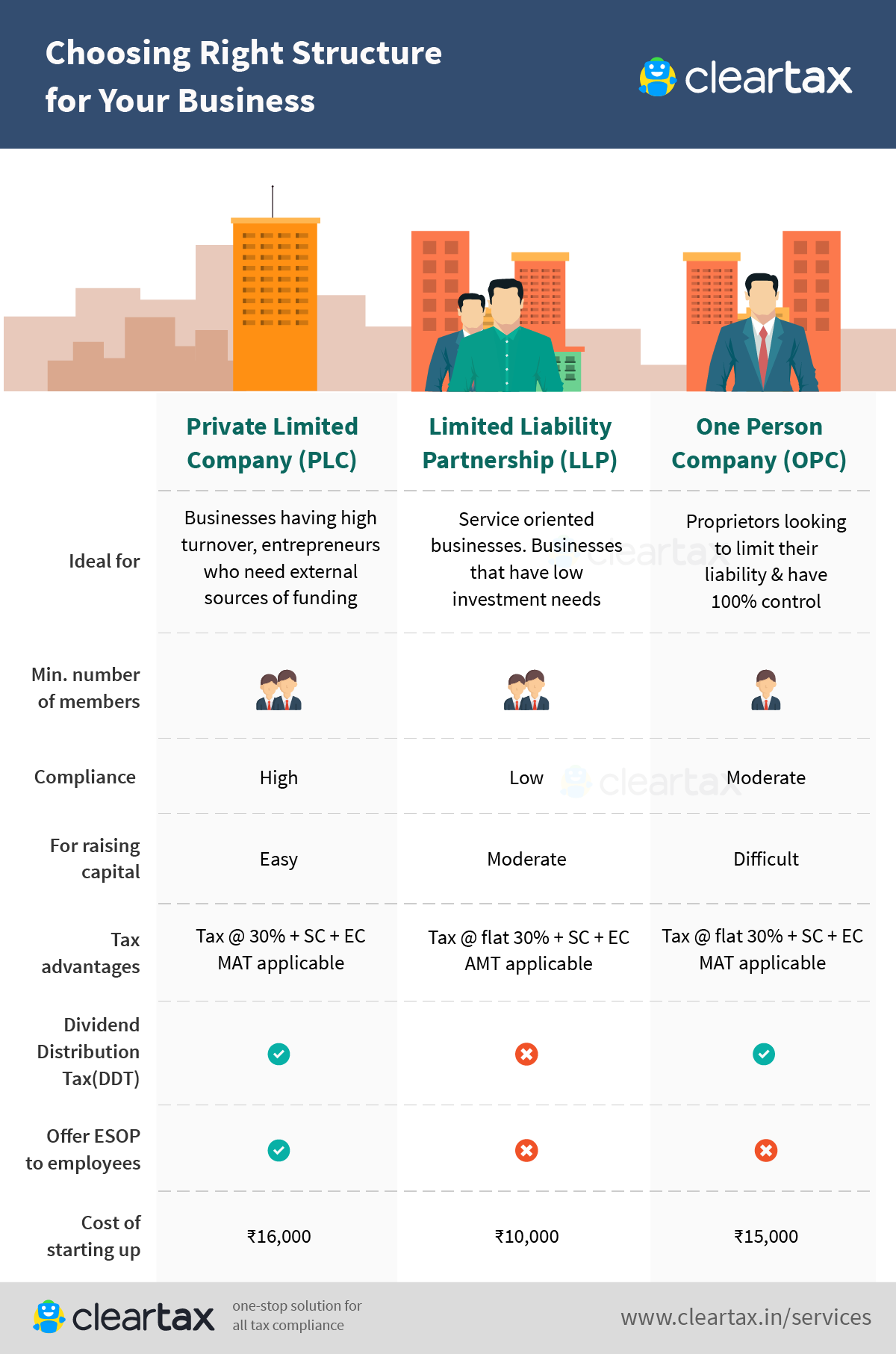

Plc Llp Opc Choose The Right Business Structure For Your Company

1

How Do I Take Money Out Of A Limited Company

Step By Step Infographic Changing From A Sole Trader To A Limited Company Markel Direct Uk

How To Legally Take Money Out Of A Limited Company Company Debt

Setting Up A Limited Company Contractors Accounting 360

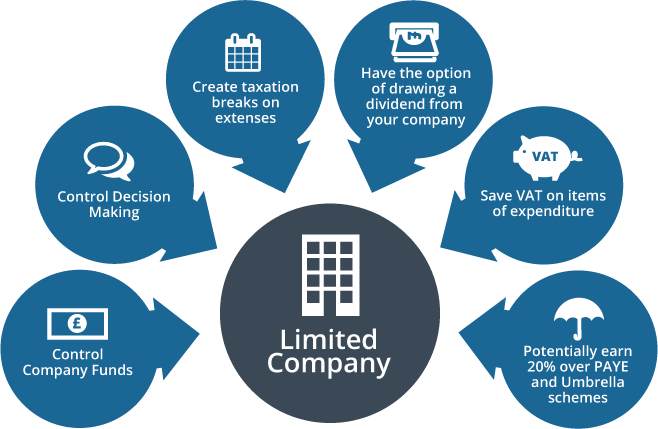

Limited Company Advantages And Disadvantages

Welcome To Rsjestore

10 Things You Should Know Before Setting Up A Limited Company It Contracting

Starting A Limited Company A No Nonsense Guide Crunch

How Does A Limited Company Work

Q Tbn 3aand9gcsjiqvbrjpq0dg02hnzq24krz1goopmhkn32xyz 0svhwtajugf Usqp Cau

Advantages And Disadvantages Of Private Limited Company Ebizfiling

10 Things You Should Know Before Setting Up A Limited Company It Contracting

Advantage Of Private Limited Company Over Limited Liability Partnership

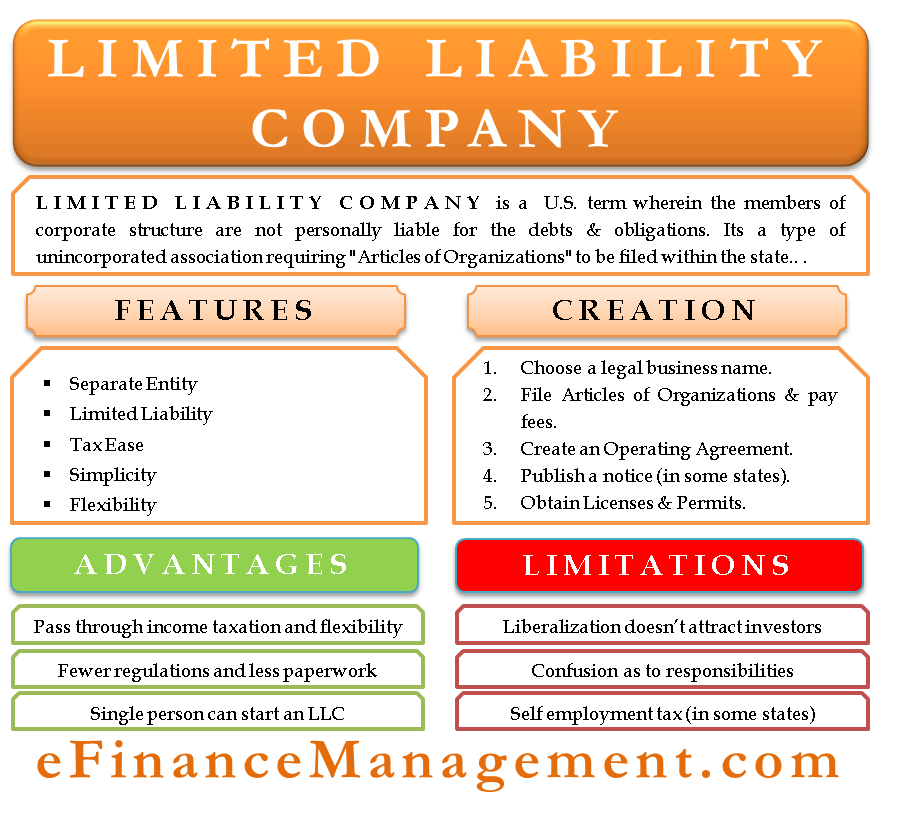

Limited Liability Company Llc Advantages Disadvantages

Private Limited Company Definition Advantages Disadvantages

What Is A Limited Liability Partnership Definition Advantages Disadvantages Video Lesson Transcript Study Com

10 Advantages Of Running Your Business As A Limited Company Instead Of Being Self Employed Bytestart

Setting Up A Private Limited Company In Singapore Rikvin

Sole Trader Vs Limited Company What Is The Best Option Company Formation Madesimple

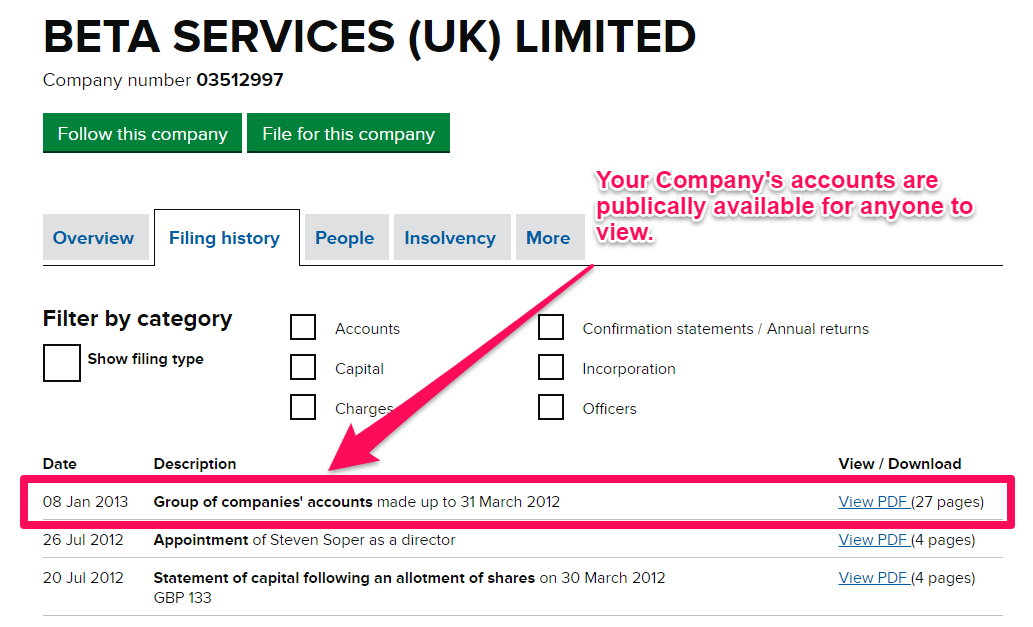

What Does It Mean To Be A Limited Company Companies House

Can You Set Up A Limited Company With One Person

/limited-liability-company-on-the-sticky-notes-with-bokeh-background-1158519140-44f25af400984f9a9433816c92076223.jpg)

Limited Liability Company Llc Definition

1

Benefits And Advantages Of Private Limited Company Legaldocs

Public Limited Company Features Advantages And Process

Limited Company Formation Capital Office

How To Set Up A Limited Liability Company In Ireland Irish Limited Company

Designations In A Private Limited Company Myonlineca

10 Important Advantages Of Limited Companies Mint Formations

Limited Liability Company Meaning Features Pros Cons

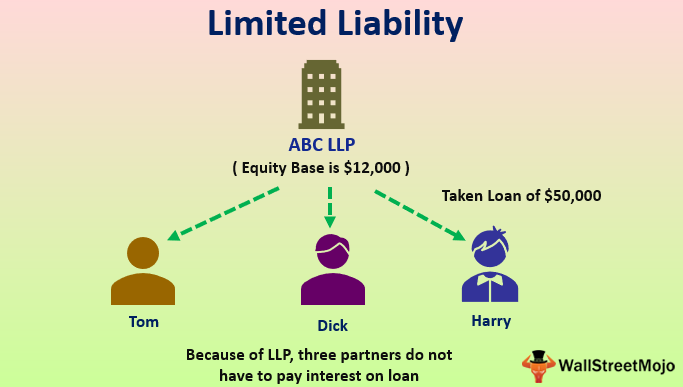

Limited Liability Meaning Examples 2 Types Of Limited Liabilites

Difference Between A Llp And A Private Limited Company Faq

Do I Have To Use Limited In My Company Name

Ppt Limited Companies Powerpoint Presentation Free Download Id

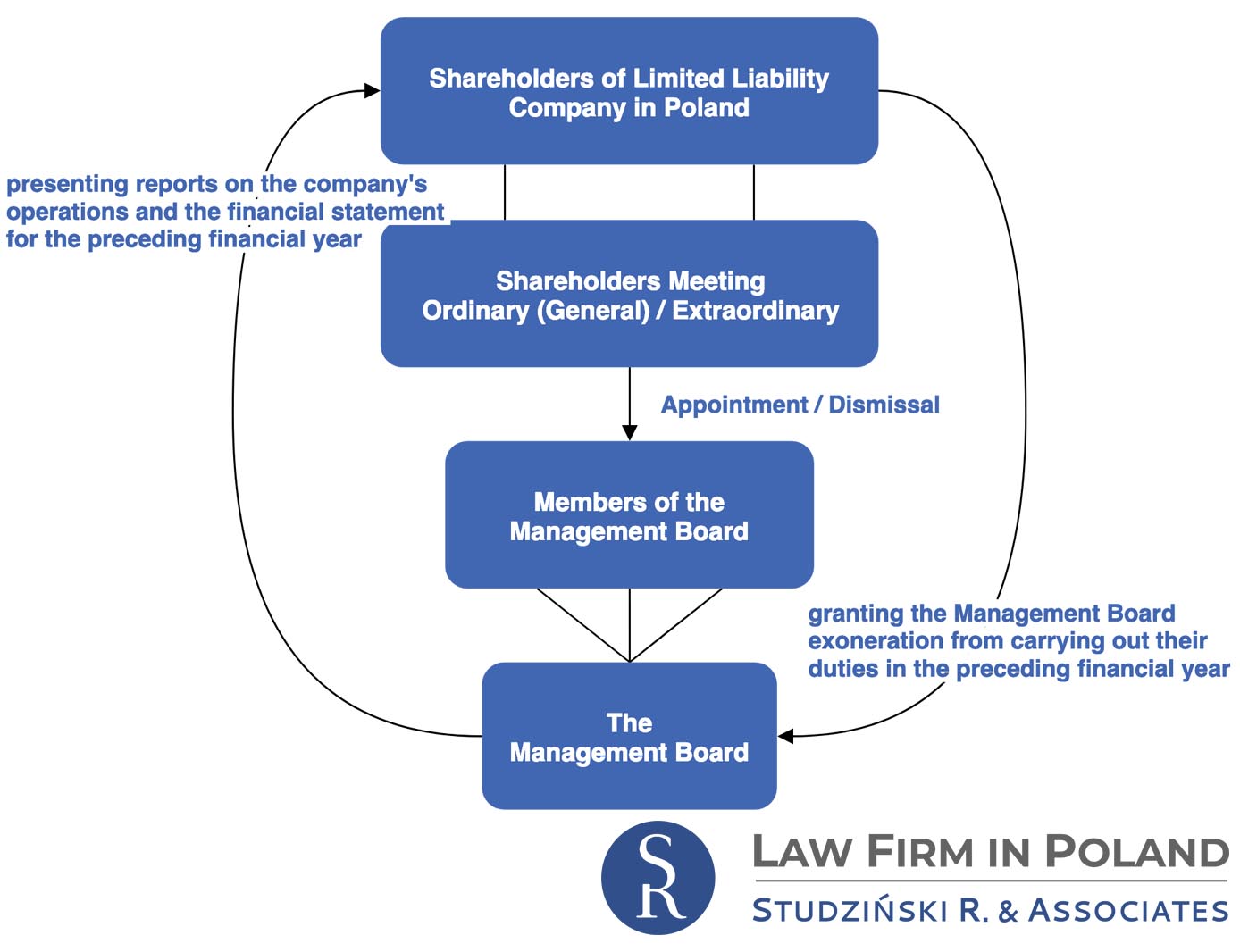

Corporate Structure Of Limited Liability Company In Poland

Advantages And Disadvantages Of A Limited Liability Company

What Is The Difference Between A Private And Public Limited Company The Accountancy Partnership

Tax Efficient Ways To Pay Yourself Through A Limited Company Bytestart

Setting Up A Private Limited Company In Singapore Rikvin

What S The Advantage Of Becoming A Limited Company Quora

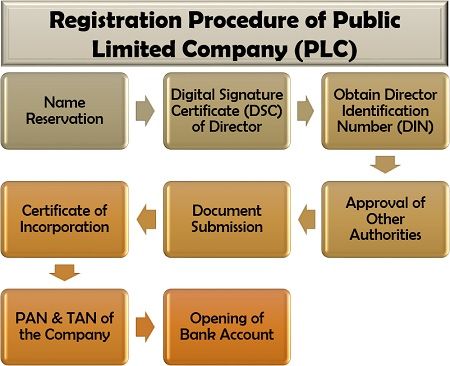

What Is A Public Limited Company Plc Definition Example Characteristics Incorporation Registration Procedure Advantages Disadvantages The Investors Book

What Is A Private Limited Company In India Busting The Myths

Everything You Need To Know About Private Limited Company Registration Mark Will

What Is A Limited Liability Company Llc Kloss Stenger Gormley Llp

What Is A Limited Company

Advantages And Disadvantages Of A Limited Company Thecompanywarehouse Co Uk

What Is An Ltd Company And What Is A Pvt Ltd Company Quora

How To Form A Singapore Private Limited Company Registration Guide

Private Vs Public Limited Company Difference Between Them With Definition Comparison Chart Youtube

What S The Difference Between An Llp And Limited Company The Accountancy Partnership

Limited Liability Company Wikipedia

Private Limited Company Characteristics Advantages Etc Legalraasta